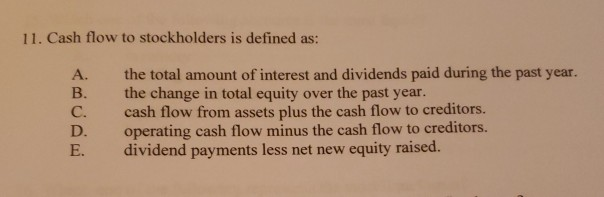

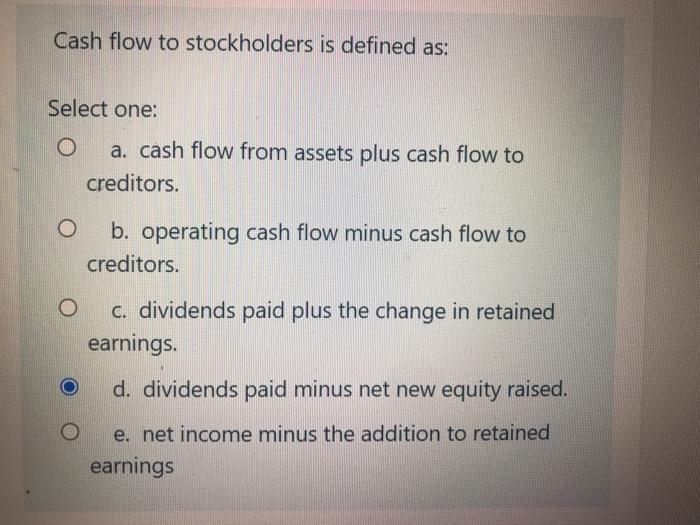

Cash Flow to Stockholders Is Defined as:

Examples of Stockholders Equity Accounts. Stockholders equity is the value of a firms assets after all liabilities are subtracted.

Solved 11 Cash Flow To Stockholders Is Defined As The Chegg Com

Earnings Per Share EPS Revenue Recognition Principle Examples of Revenue and Gain Accounts Examples of Expense and Loss Accounts.

. Cash flow to creditors minus cash flow to stockholders is equal to cash flow from assets. Minimum cash balance is 5000. Beginning loan balance is 4500 what will be the cash balance on the pro forma cash budget at the end of January.

A company like Countrywide generally doesnt want to foreclose on underwater homes on the other hand if they have cash-flow problems theyll need to push those foreclosures through so they can stop. The adjustments are grouped under operating activities Cash Flow from Operations Cash flow from operations is the section of a companys cash flow statement that represents the amount of cash a company. The amount of cash or cash-equivalent which the company receives or gives out by the way of payments to creditors is known as cash flow.

This chapter uses a. Statement of Cash Flows provides information about the cash flow of a company. The statement of comprehensive income should be presented immediately after the income statement.

There are a lot of weird incentives here. Amount of discretionary cash flow a company has. Read more or Free Cash flow to Equity Free Cash Flow To Equity FCFE Free Cash Flow to Equity determines the remaining cash with the companys investors or equity shareholders after extending funds for debt repayment interest.

Stockholders equity is not the same as cash on hand. It gives a snapshot of the amount of cash coming into the business from where and amount flowing out. Income Statement provides information about the performance of a company.

Statement of Stockholders Equity Statement of Cash Flows SCF Part 7. Annual meeting of stockholders. Investor Relations Todays IBM has defined a clear strategy to lead in the era of hybrid cloud and AI.

Preferred stock is discussed later While common sounds rather ordinary it is the common stockholders who elect the board of directors vote on whether to have a merger with another company and see their shares of stock increase in value if the corporation is successful. If projected net cash flow for January is 6500. Existing situation involving uncertainty as to possible gain or loss.

Financing activities include transactions involving debt equity and dividends. However it could be combined with the income statement The term. See the supplemental schedules for a reconciliation of fourth quarter.

Submit a question for the annual meeting. As used by the Company free cash flow is defined as net cash provided by operating activities adjusted for changes in operating assets and liabilities deferred obligations on the early settlement of commodity derivative contracts and cash acquisition transaction costs less capital expenditures. The debt ratio is defined as the ratio of total debt to total assets expressed as a decimal or.

Industries most sensitive to inflation-induced profits are those with. If a corporation has issued only one type or class of stock it will be common stock. It can be represented with the accounting equation.

Calculate FCFF Calculate FCFF FCFF Free cash flow to firm or unleveled cash flow is the cash remaining after depreciation taxes and other investment costs are paid from the revenue. Declared Q4 2021 cash dividend of 060 per share payable on March 11 2022. Implies a 18 annualized yield based on the February 18 2022 share closing price of 13147.

With Countrywide having a 15-trillion servicing portfolio that puts tremendous strain on its cash flow Cannon said. Free Cash Flow as defined and reconciled below of 772 million. In contrast under the indirect method cash flow from operating activities is calculated by first taking the net income from a.

The cash flow statement begins with the net income and adjusts it for non-cash expenses changes to balance sheet accounts and other usages and receipts of cash. Beginning cash balance is 16000. Read more is as follows.

FAQs about the Kyndryl Holdings Inc. Cash flow from operating activities. Notes to Financial Statements Other Information Pertaining to Financial Statements.

Its also known as owners equity shareholders equity or a companys book value. A True b False. It represents the amount of cash flow available to all the funding holders debt holders stockholders preferred stockholders or bondholders.

Additionally S-X Article 8 notes. Cash flow analysis is often used to analyse the liquidity position of the company. It represents the amount of cash flow available to all the funding holders debt holders stockholders preferred stockholders or bondholders.

Statement of Comprehensive Income. What is stockholders equity. Increasing annual dividend by 200 to 240 per share.

Specific principles bases conventions rules and practices applied by a company in preparing and presenting financial information Summary of Significant Accounting Policies the first note to the financial statements. Qualifying Emerging Growth Companies as defined in the Jumpstart Our Business Startups JOBS Act and Smaller Reporting Companies as defined in S-K 10f are permitted to omit the earliest year income statement and statements of comprehensive income cash flows and changes in stockholders equity in an initial public offering. Generally speaking equity is the value of an asset less the amount of all liabilities on that asset.

Cash flow from financing activities CFF is a section of a companys cash flow statement which shows the net flows of cash that are used to fund the company. Repurchased 3858931 shares of common stock 21 of prior quarter. Use the following information for Ingersoll Inc.

Even if we use the modified version of the model and treat stock buybacks as dividends we may misvalue firms that consistently return less or more than they can afford to their stockholders. FREE CASH FLOW TO EQUITY DISCOUNT MODELS The dividend discount model is based upon the premise that the only cashflows received by stockholders is dividends. The debt ratio is a financial ratio that measures the extent of a companys leverage.

You might think of it as how much a company would have left over in. See the Q1 2022 Earnings Announcement FAQs on the Kyndryl Holdings Inc.

Solved Cash Flow To Stockholders Is Defined As Select One Chegg Com

Comments

Post a Comment